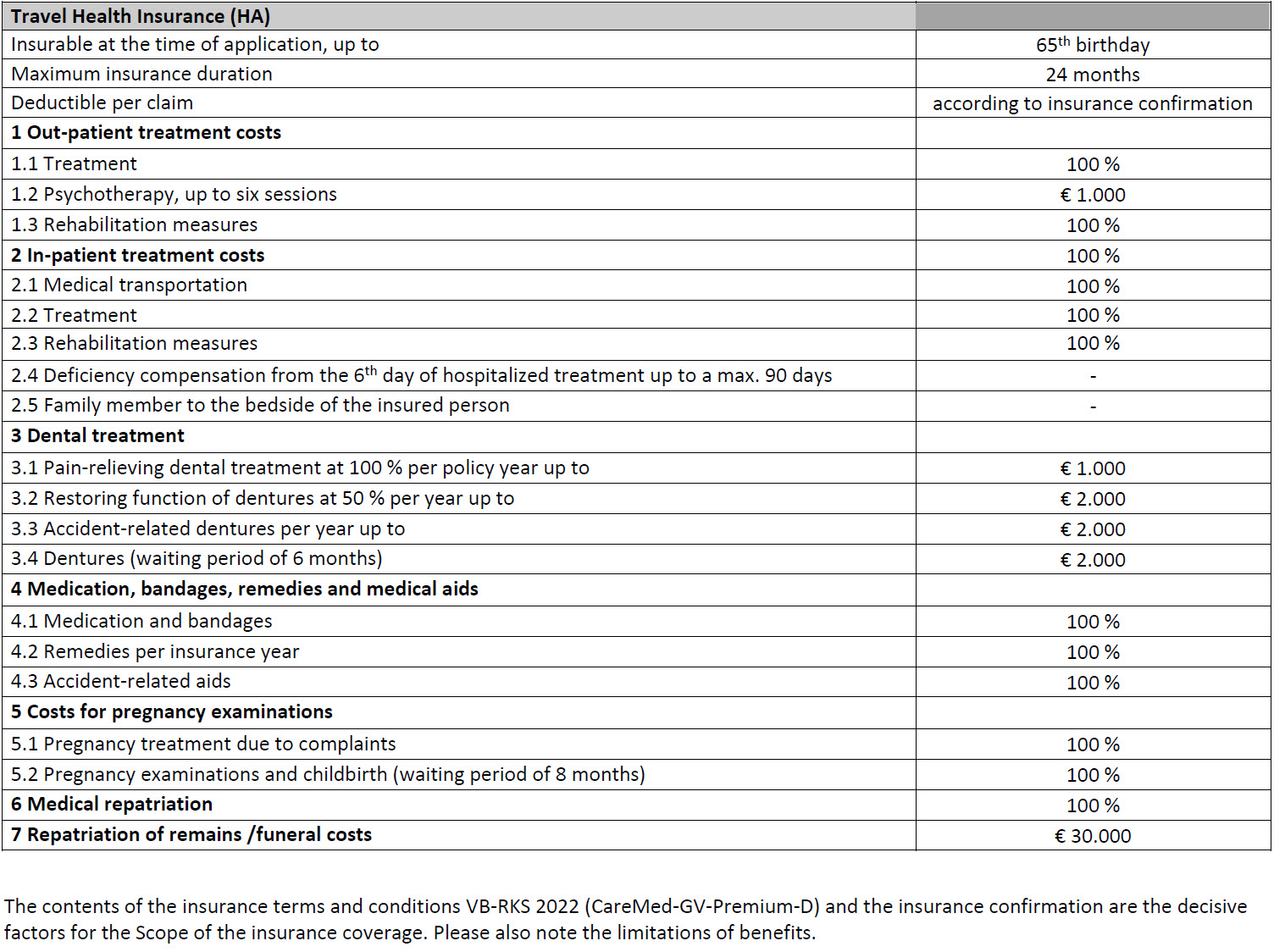

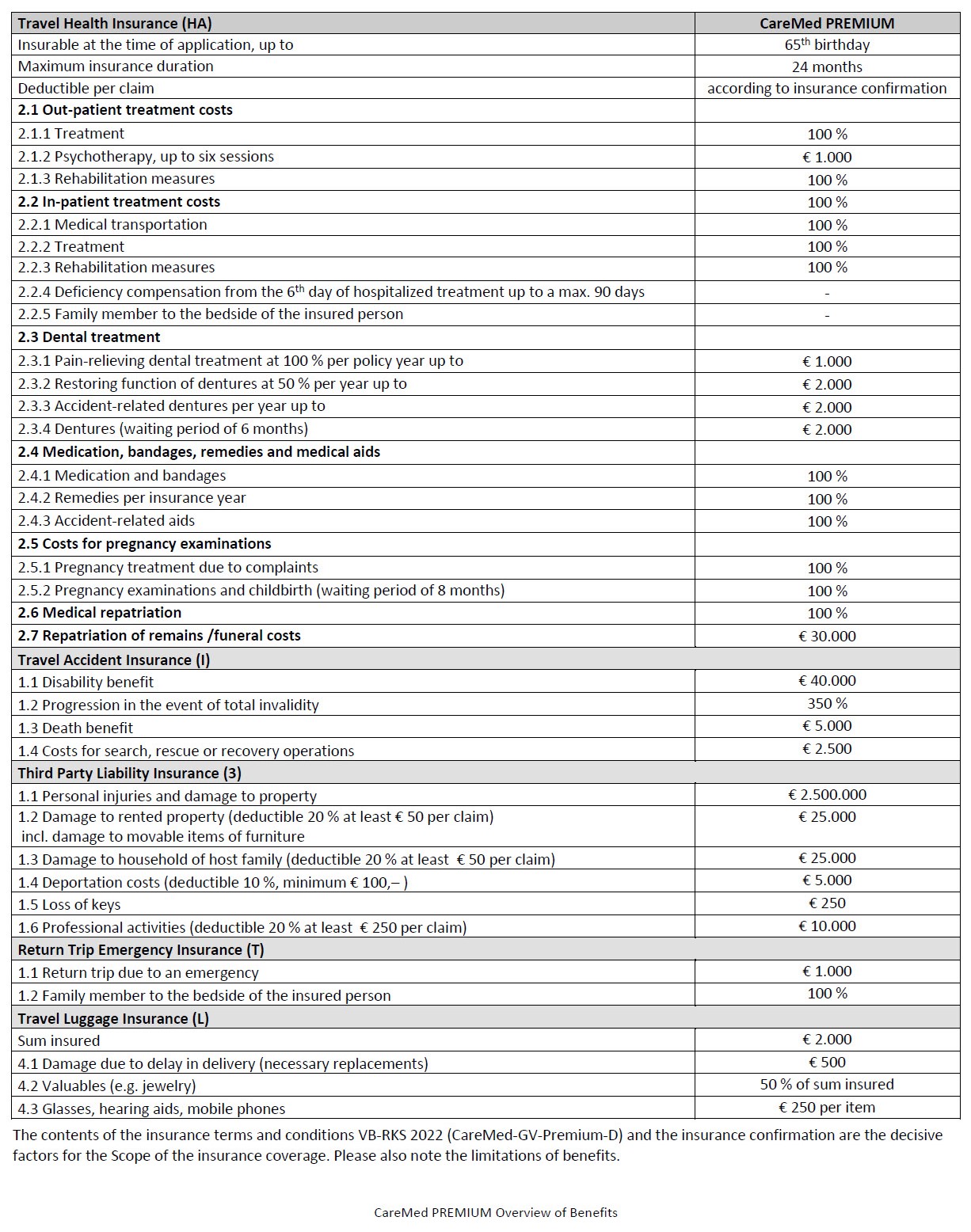

Travel Health Insurance

Special adventures need special protection

We know that - once you have made the decision to travel abroad, the travel bug hits straight away! But over all the excitement, don't forget to think about a suitable travel insurance. To participate in our overseas programs, you need at least a travel health insurance to be covered in case of illness or accident. We all hope that you will stay healthy, but there is always a risk that you may need medical assistance during your stay abroad.

So that you can enjoy your adventure abroad carefree, you may also think about Liability Insurance and Luggage Insurance.

From our experience we know the special needs of our program participants and also know that these can change now and then. So you do not have to worry, we cooperate with the international insurance provider CareMed and can offer you optimal insurance coverage, perfectly tailored to your stay abroad.

Your “carefree-around-the-world“ options

Travel Health Insurance: US$ 1.55/day (no deductible!)

Premium Insurance: US$ 2.20/day (no deductible!)

Travel Cancellation Insurance (optional)

2.4% of the travel costs

10 good reasons for our insurance

- Optimal insurance cover for your stay abroad

- 100% coverage for outpatient and inpatient treatment

- We take out the insurance for you. You don't need to fill out any forms or questionnaires

- Worldwide coverage (with or without USA/Canada)

- No deductible!!

- 24-hour emergency call service

- Language trips, working holidays, au pairs, internships, farm stays and volunteer work are covered

- Fulfillment of visa requirements for Working Holiday Visa and Schengen Visa

- Extensions are possible. (Pre-existing illnesses are not insured in the following insurance period. It is therefore advisable to take out insurance for the entire period before leaving the country.)

- If taken out for at least 12 months, insurance cover in the home country for up to 6 weeks within a year

Without guarantee! Please note that the above information may not be complete since not the full coverage and terms can be detailed in this short overview. The full scope of the insurance is set out in the insurance policy, the product description and the terms and conditions. This information is available upon request.